PwC 2023 Global M&A Industry Trends Outlook: Global M&A market falls below record 2021 levels on recession fears, but will return to growth in the second half of 2023

31 Ianuarie 2023 BizLawyer

The optimism also comes as 60% of global CEOs indicated in the latest PwC CEO Survey that they do not intend to delay deals planned for 2023, despite fears of recession, rising interest rates, falling valuations, geopolitical tensions and supply chain disruptions.

|

The optimism also comes as 60% of global CEOs indicated in the latest PwC CEO Survey that they do not intend to delay deals planned for 2023, despite fears of recession, rising interest rates, falling valuations, geopolitical tensions and supply chain disruptions.

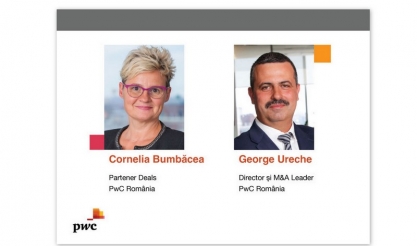

"Although globally there was a decrease, the Romanian transaction market had a very good year 2022, both in volume and value, the difference compared to 2021 being given by several transactions of more than EUR 100 million, as well as a transaction of more than EUR 1 billion closed in the energy sector. Even if 2023 is shaping up to be a year with many challenges and uncertainties, strategic acquisitions and investment portfolio optimization remain a priority, regardless of challenging macroeconomic and geopolitical factors, helping CEOs to reposition their businesses, strengthen their growth and achieve long-term sustainable results," said Cornelia Bumbăcea, Partner Deals, PwC Romania.

M&A market outlook by sector

Mergers and acquisitions tend to slow down in times of uncertainty or market volatility, but at the same time can bring many opportunities given lower valuations, less competition for deals or new assets coming to market, including distressed ones.

“The current market conditions can provide an opportune moment for M&A, on the condition that companies have well-thought-out strategies and access to capital to make transformational deals that will shape their business and contribute to their longer-term success. So, in addition to the technology and energy sectors, we believe that investors will look to other business models that generate stable revenue streams and higher margins to ensure their viability," said George Ureche, Director and M&A Leader, PwC Romania.”

Technology, Media and Telecommunications (TMT): Software deals will continue to dominate the sector – as much as they did in 2022 – having accounted for two-thirds (71%) of tech deal activity and three-quarters (74%) of deal values. Other areas which will likely be hot spots of M&A activity in 2023 include telecoms, the metaverse and video games.

Industrial Manufacturing and Automotive (IM&A): Portfolio optimisation will drive divestitures and acquisitions, particularly those focused on sustainability and accelerating digital transformation.

Financial Services (FS): Disruption from platforms and FinTech is driving rapid technological changes across FS and will boost M&A as players seek to acquire digital capabilities.

Energy, Utilities and Resources (EU&R): Energy transition will remain a priority for investors and management teams, directing large volumes of capital to M&A and other capital project development.

Consumer markets: While challenges remain on the consumer front in 2023, portfolio reviews and a focus on transformational transactions will create M&A opportunities.

Health industries: The need to innovate and transform businesses to achieve growth goals will drive M&A activity in 2023. Biotech, CRO/CDMO, MedTech, consumer-facing healthcare and digital health solutions are expected to attract strong investor interest.

Global M&A activity by region

Global M&A activity in 2022 varied by region, with more deals in Europe, the Middle East and Africa (EMEA) in 2022 than in the Americas and Asia Pacific (APAC) regions – despite higher energy costs and regional instability.

In EMEA, deal volumes and values declined by 12% and 37%, respectively, between 2021 and 2022, in the Americas by 17% and 40%, and in the Asia-Pacific the drop was by 23% and 33%.

At the same time, the number of megadeals in the US - deals worth more than USD 5 billion - has almost halved, from 81 in 2021 to 42 last year.

| Publicitate pe BizLawyer? |

|

| Articol 836 / 4652 | Următorul articol |

| Publicitate pe BizLawyer? |

|

Filip & Company a asistat Veranda Obor S.A. în obținerea unei finanțări de 36 milioane euro de la CEC Bank. Echipa, coordonată de Alexandra Manciulea (partner) și Rebecca Marina (counsel)

LegiTeam: CMS CAMERON MCKENNA NABARRO OLSWANG LLP SCP is looking for: Associate | Commercial group (3-4 years definitive ̸ qualified lawyer)

O promovare din interior care confirmă meritocrația și creșterea organică într-una dintre cele mai puternice firme de avocatură din România | De vorbă cu Ramona Pentilescu, avocatul care a crescut în PNSA de la primii pași în profesie până la poziția de partener, despre vocație, rigoare și reperele care i-au susținut evoluția profesională într-un cadru în care contează respectul pentru profesie și coerența valorilor

Filip & Company și Legal Ground, arhitecții juridici ai tranzacției prin care BT Property, fondul imobiliar al Grupului Banca Transilvania, a cumpărat complexul de birouri Record Park din Cluj-Napoca de la un fond belgian. Echipele de avocați, coordonate de Ioana Roman și Alina Stancu Bîrsan, pentru cumpărător, și Alex Bumbu, pentru vânzător

Bondoc & Asociații, consultanții vânzătorilor în tranzacția prin care Grupul LuxVet preia rețeaua Mobile Vet

Neagu Dinu Partners, firmă înființată anul trecut, își face rapid loc în prim-planul practicii de Litigii & Arbitraj din piața locală, cu un model de lucru pragmatic, în care partenerii cooordonează dosarele și păstrează controlul calității în mandate complexe | De vorbă cu Simona Neagu (Partener fondator) despre așteptările tot mai ridicate ale clienților, colaborările internaționale și disciplina internă care susține performanța echipei

LSEG Deals Intelligence | Cum s-au împărțit fuziunile mid-market, anul trecut, pe firmele de avocatură active și la București. CMS a fost pe podium în Europa și pe primul loc în Estul continentului, unde s-au mai evidențiat Schoenherr și Clifford Chance. Tranzacții mai multe, dar de valoare mai mică în Europa Estică

Consolidare strategică pe piața serviciilor medicale: Regina Maria achiziționează Neuroaxis, liderul clinicilor de neurologie din România | Ce consultanți au fost în tranzacție

Clifford Chance Badea, consultant în emisiunea de obligațiuni prin care UniCredit Bank a atras 600 milioane de lei

Studenții la Drept sunt invitați la Turneul de dezbateri „Law and Life in Contest” organizat de Bondoc și Asociații

LegiTeam | RTPR is looking for a litigation lawyer (3-4 years of experience)

Filip & Company asistă Continental în vânzarea OESL către Regent. Alexandru Bîrsan (managing partner) a coordonat echipa

-

BizBanker

-

BizLeader

- in curand...

-

SeeNews

in curand...

RSS

RSS